Scheme highlights

The Local Government Pension Scheme (LGPS) is a nationwide statutory funded scheme for local government employees and is very safe and secure. The Scheme is administered locally by Lothian Pension Fund.

The LGPS gives you:

- a pension when you retire once you’ve been in for two years

- the option to retire from age 55 (benefits will be reduced)

- option to swap annual pension for a tax-free lump sum (up to 25%) at retirement

- tax relief on your contributions

- employer contribution of £2 for every £1 you as a member pay in

- life cover in form of a death grant 3 x assumed pensionable pay

- a pension for your close eligible dependents.

What is the CARE Scheme?

From 1st April 2015, the LGPS became a Career Average Revalued Earnings (or CARE) scheme. A CARE scheme calculates pension using the formula:

Pension = Accrual Rate & Pensionable Pay

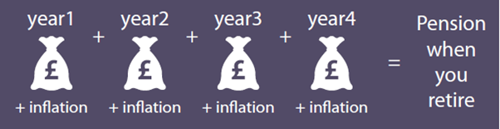

In a CARE scheme the pensionable pay for each year of membership is used, to calculate a pension amount for that particular year. That pension amount is then revalued each year in line with inflation (it should be remembered that, while your CARE pension might be expected to increase each year, the pension amount could be reduced should there be negative inflation). These individual pension amounts are then added together to arrive at the total pension payable from the scheme.

In the LGPS, the accrual rate for the main scheme is 1/49th. In the optional "50-50" scheme the accrual rate is 1/98th (that is half of a 1/49th) - but you pay only half the contribution rate of the main scheme.

How much does it cost?

How much it costs you depends on how much you are paid, but it will be between 5.5% and 11.2% of your pensionable pay.

Your rate will depend on the level of your pensionable pay - you can see the rate you will pay on the table of contribution rates.

The real cost to you will be less because you do not pay tax on the amount you pay into your pension.

If you work part time or term time your contribution rate will be based on your actual pay and you will only pay contributions on that actual pay.

What is a pension?

When you first start working your retirement will seem like it's a long way off, but regular amounts add up over time. A pension is a source of regular income to live on when you retire, and you can see how pensions build up in the video below.

You may not have much spare money when you're just starting out in the workforce and saving for your retirement might not be high on your list of priorities.

Being able to join a scheme like the LGPS can be an advantage, helping you on your way to a reasonable level of income when you retire. But the pension you eventually receive and any other pensions you might have built up may not be enough for you to retire comfortably on.

If you can afford it, it may be worth putting away a bit of extra into your pension each pay day. It doesn't even need to be much, but whatever you put in will build up over time and, you could be thanking yourself later. Find out how you can pay extra into your pension.

Any decision to join a pension scheme or to pay extra in is an important one and you should make sure you receive proper financial advice before making any decisions.

You can also visit the Retirement Living Standards website to help you picture the kind of lifestyle you could have in retirement. You can also watch their ‘Picture your Future’ video below.

Related Content

Join

Information about joining

Pay Extra

Find out how to increase or decrease the amount you pay with AVCs, APCs and the 50/50 scheme.

Transfer In

Find out if you can transfer previous pension into the Fund.

Popular Questions

Help Hub-

What are the benefits of the LGPS?

The LPGS gives you:

- Secure benefits – the Scheme provides you a future income, independent of share prices and stock market fluctuations.

- At a low cost to you – with tax-efficient savings and options to pay extra.

- Your employer pays in too – the scheme is provided by your employer who meets the balance of the cost of providing your benefits in the LGPS.

-

What kind of scheme is it?

- Defined benefit occupational pension scheme where the benefits are worked out on the years you have paid into the pension scheme and the pay you have earned.

- Eligible employees are automatically enrolled by their employer

- Once you have met the 2 year membership period, you can be paid an annual pension for life with the option to take up to 25% as a tax free lump sum at retirement.

- The LGPS is very secure because the benefits are set out in law.

-

Can I join?

The LGPS covers employees working in local government and for other organisations that have chosen to participate in it. To be able to join the LGPS you need to be under age 75 and work for an employer that offers membership of the scheme. If you are employed by a non-local government organisation which participates in the LGPS you can only join if your employer nominates you for membership of the scheme. Police officers, operational firefighters and, in general, teachers and employees eligible to join another statutory pension scheme (such as the NHS Pension Scheme) are not allowed to join the LGPS.

If you start a job and are eligible for membership of the LGPS, you’ll be brought into the Scheme by your employer automatically if you have a contract of employment for 3 months or more.

If it is for less than 3 months and you are, or become eligible, you’ll be brought into the scheme from the next pay period :

- from the automatic enrolment date (unless your employer issues you with a postponement notice to delay bringing you into the scheme for up to a maximum of 3 months)

- or if your contract is extended to be for 3 months or more

- or you join by completing an application form.

If you are brought into the scheme you have the right to opt out. You can’t complete an opt out form until you have started your employment.

-

How do I ensure that I have become a member of the LGPS?

On joining the LGPS relevant records and a pension account (for each employment in the scheme if you have more than one) will be set up and an official notification of your membership of the LGPS will be sent to you. You should check your payslip to make sure that pension contributions are being deducted.

-

Can I opt-out of the LGPS and re-join at a later date?

Yes you can opt-out of the scheme but if you are thinking of opting out you might want to first consider an alternative option which is to elect to move to the 50/50 section of the scheme. The 50/50 section allows you to pay half your normal contributions in return for half your normal pension build up. To find out more, see the section on 50/50. Complete a form to apply or leave the 50/50 section.

If having considered the 50/50 option you still decide the LGPS is not for you, you can leave the LGPS at any time on or after your first day of eligible employment by giving your employer notice in writing by completing an opt out form. You might, however, want to take independent financial advice before making the final decision to opt out.

If you opt-out before completing 3 months membership you will be treated as never having been a member and your employer will refund to you, through your pay, any contributions you have paid during that time.

If you opt out of the LGPS with 3 or more months membership and before completing the 2 years vesting period you may be able to take a refund of your contributions (less any statutory deductions) or transfer out your pension to another scheme.

To opt out, complete an opt out form and return it to your employer

If you opt out of the LGPS after meeting the 2 years vesting period you will have deferred benefits in the scheme and have options when you leave.

If you opt-out, you can, provided you are otherwise eligible to join the scheme, opt back into the scheme at any time before age 75.

If you opt out of the LGPS then:

- your employer is required to comply with the automatic enrolment provisions under the Pensions Act 2008 and will automatically enrol you back into the LGPS if you are eligible at that time in the job you’ve opted out from, or

- if you are not eligible for automatic enrolement in the job you opted out from, but subsequently become eligible in that job, your employer will automatically enrol you back into the LGPS from their next automatic enrolment date.

Your employer must notify you if this happens. You would then have the right to again opt out of the LGPS. However your employer will normally automatically enrol you back into the LGPS approximately every 3 years from the date they have to comply with the automatic enrolment provisions provided, you are eligible.

However, in any of the above cases, your employer can choose not to automatically enrol you if:

- you had opted out of the LGPS less than 12 months prior to the date you would have been automatically enrolled in the job, or

- notice to terminate employment has been given before the end of the period of 6 weeks beginning with what would have been automatically enrolled in the job, or

- your employer has reasonable grounds to believe that, on what would have been the date they would have automatically enrolled you, you hold Primary Protection, Enhanced Protection, Fixed Protection, Fixed Protection 2014, or Individual Protection 2014, Fixed Protection 2016 or Individual Protection 2016, or

- you hold office as a director of the company by which you are employed,

- you are a member of a limited liability partnership (LLP), have earnings payable by the LLP but you are not treated for income tax purposes as being employed by the LLP.

-

What do I pay?

The rate of contributions you pay is based on how much you are paid. There is a tier contribution system with your contributions based on how much of your pensionable pay falls into each tier. You can see the contribution rates table here. If you elect for the 50/50 section of the scheme you would pay half the rates. When you join and every April afterwards, your employer will decide your contribution rate.

Your employer must also review your contribution rate if you have a permanent material change to your terms and conditions of employment during the Scheme year (1 April to 31 March) which affects your pensionable pay.

The pay ranges will be increased each April in line with the cost of living and the contribution rates and /or pay bands will be reviewed periodically and may change in the future.

-

Do I get tax relief?

As a member of the LGPS, if you earn enough to pay tax your contributions will attract tax relief at the time they are deducted from your pensionable pay. There are restrictions on the amount of tax relief available on pension contributions. If the value of your pension savings increase in any one year by more than the standard annual allowance of £40,000 (2020/21) you may have to pay a tax charge. Most people will not be affected by the annual allowance. You can find more about tax and your pension on our members section.

-

Can I transfer in pension from my previous scheme?

The LGPS can only accept transfers from other public sector schemes (i.e. local councils schemes in Great Britain, the Civil Service, the Health Service, the Teachers' pension scheme, the Police and Fire schemes and Armed Forces schemes etc). We can no longer accept transfers in from personal pension policies, including stakeholder plans, or from non-club schemes.

If you have pension rights with a Public Sector Scheme, transfer requests require to be made within 12 months of joining the LGPS.

If you meet the above criteria and wish to apply to transfer a previous pension from a Club Scheme, download and complete a transfer form. The form is also available within your welcome pack which can be found on our My Pension online facility.